Why Bonding Curves?

The Liquidity Challenge for Token Founders

One of the primary challenges for token founders post-issuance is straightforward: "How do we secure liquidity?" Without liquidity, tokens remain illiquid assets that can't be effectively traded, used, or valued in the market.

Onyx relies on bonding curves to generate predictable liquidity for early stage token launches. Founders can focus on building their product and community rather than mastering liquidity provisioning.

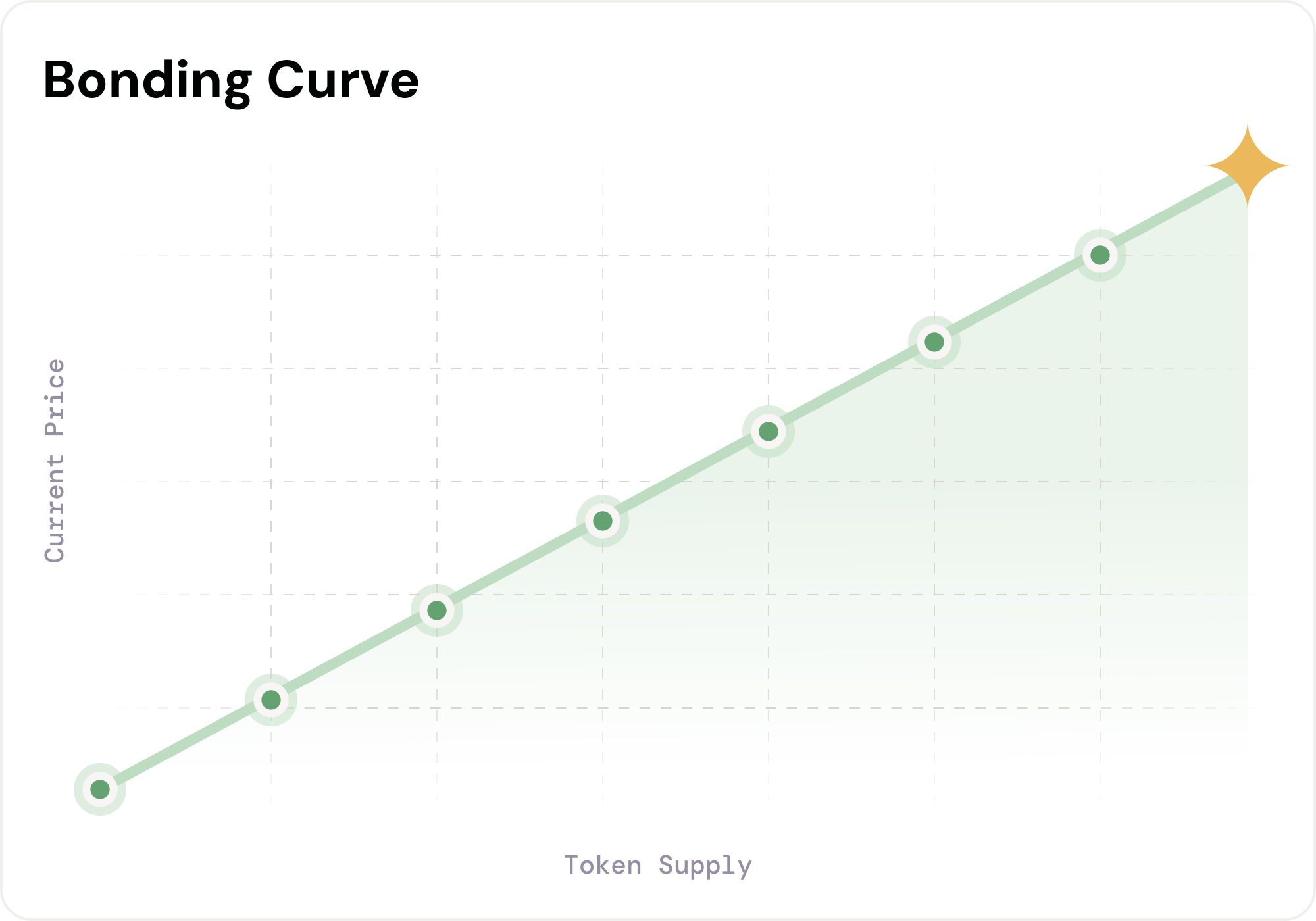

Our Bonding Curve Solution

Onyx leverages a linear bonding curve mechanism that creates a predictable price trajectory for your token. This approach allows your token to start at near-zero value and grow steadily as buyers enter the market.

How Onyx Bonding Works

- Token Allocation: Founders allocate 30% of their token supply to a bonding contract

- Bonding Cap Configuration: We set a maximum USDC cap that can be raised during the bonding process

- Automated Liquidity Creation: Once the cap is reached, the contract automatically creates a Uniswap V2 liquidity pool

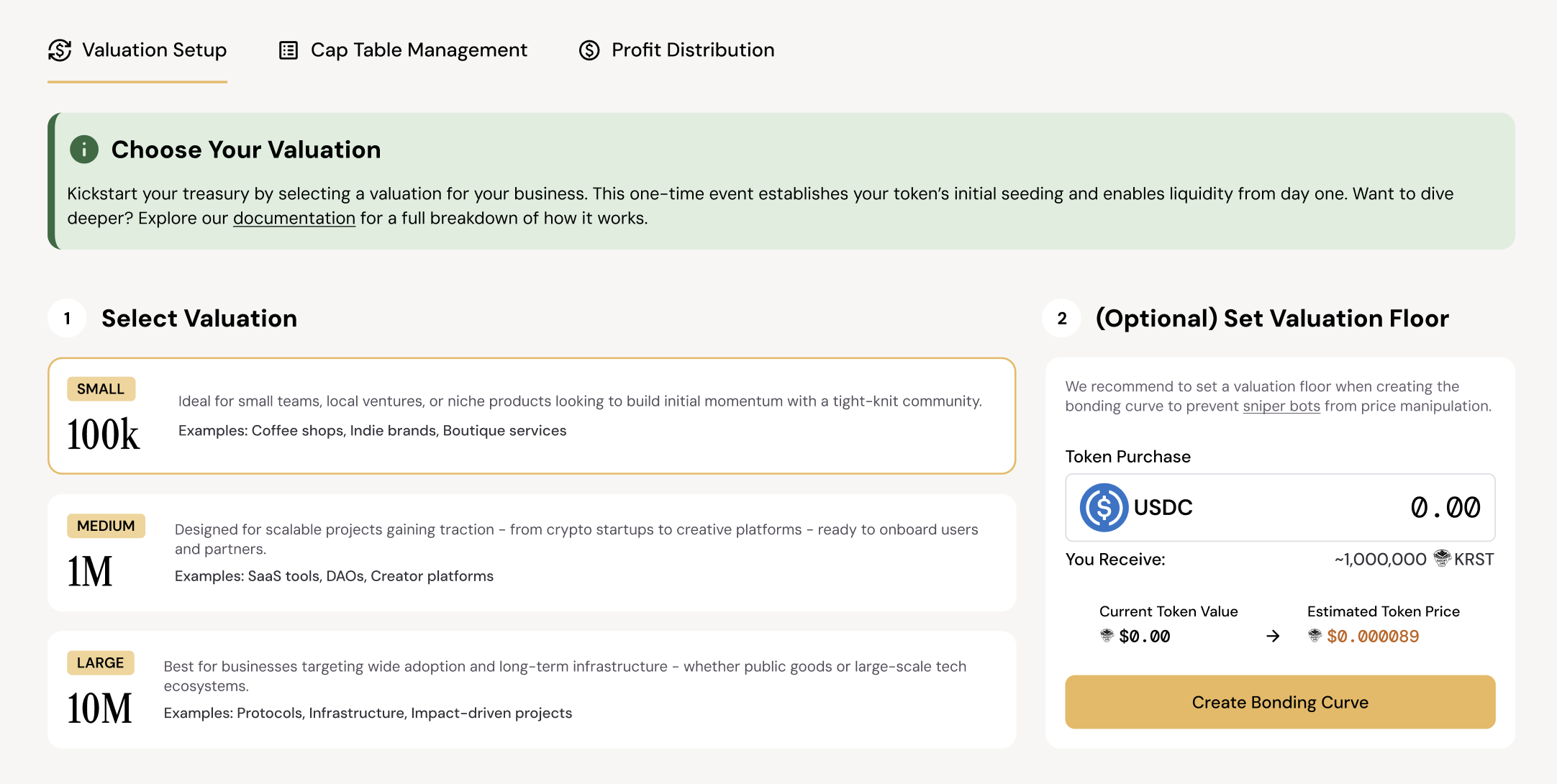

Setting the Right Parameters

Onyx simplifies the process. Choose one of three options that best match your business valuation.

Behind the scenes:

- Bonding Cap: These are the USDC caps based on your business valuation.

- Example: 100K business size = 15K USDC cap

- Example: 1M business size = 150K USDC cap

- Example: 10M business size = 1.5M USDC cap

These USDC caps allow for a final liquidity-to-market-cap ratio of 30%, a level we believe to be healthy for your token.

- Liquidity Pool Supply: 50% of your initial token allocation is reserved exclusively for creating the Uniswap V2 liquidity pool, ensuring sufficient liquidity depth upon market entry.

Graduation Process

Upon completion of the bonding process, the contract automatically:

- Deducts a 2.5% graduation fee from the total USDC raised

- Creates a Uniswap V2 liquidity pool with your 50% token allocation for LP and the remaining USDC

- Adds balanced liquidity using the reserved tokens and raised funds

- Locks the LP tokens permanently (sent to address 0x0)

There is also a 0.5% fee on trades against the bonding curve. This disincentivizes free price manipulation via sniping.